A balanced checkbook doesn't have to be a handwritten one several budgeting apps can be used to record deposits, withdrawals and other financial transactions.

Keeping a checkbook register, enrolling in internet banking and reconciling checks are all great ways to stay on top of what is coming in and out of the account.

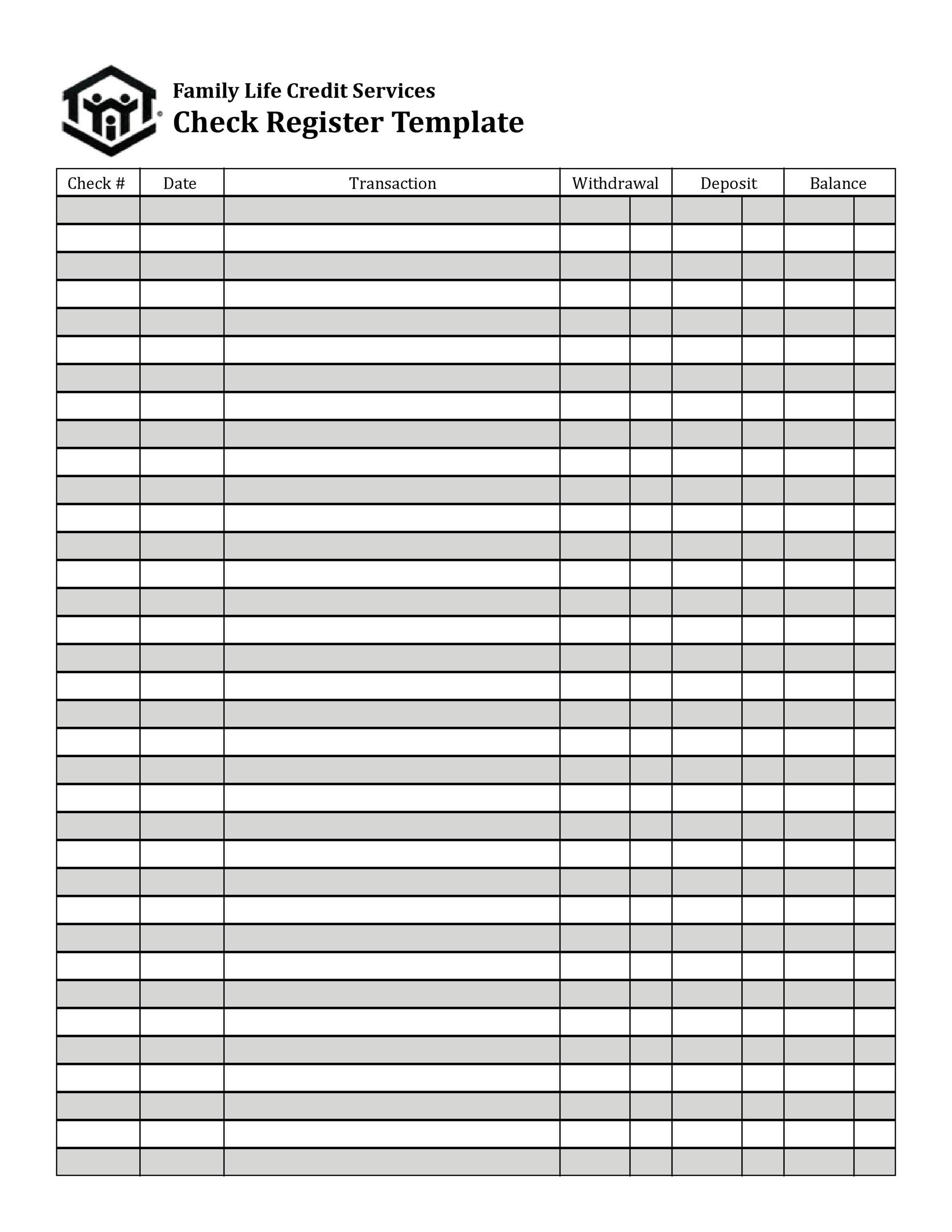

Here are the answers to some of the most frequently asked questions about checkbook balancing. A monthly budget can be set up with recurring and one-time incomes or expenses with an overview of where each penny is spent. BUDGT–Member of the gig economy? This app is great for those with a sporadic income.IOU will send reminders when money is owed and to whom. IOU–This app is great for people who lend or borrow money often.Digit moves money to the savings account each day and won’t transfer more than the user can afford. Digit–This app makes saving money easy because it’s done for you.The app connects all accounts in one convenient spot.

0 kommentar(er)

0 kommentar(er)